How To Calculate Fx Hedging Cost

In this video Im going to explain how to use NPV function in Excel to calculate the NPV of a cash flow. There are broadly two limitations of foreign exchange risks.

Portfolio Currency Hedging 101 Impacts And Costs What You Need To Understand Alfred Berg

All other trademarks appearing on this Website are the property of their respective owners.

How to calculate fx hedging cost. We also offer hedging products and custom foreign exchange forecasting. FX Options are also useful tools which can be easily combined with Spot and Forward contracts to create bespoke hedging strategies. FX options can be used to create bespoke solutions and work to remove the upfront cost of a premium this involves certain caveats around the structure of the option product.

The two most important categories in our rating system are the cost of trading and the brokers trust score. The Estimate is a guess or calculate the cost size value etc based on the knowledge and experiences. We show you the exact mark up you will pay on every foreign exchange transfer.

Cost Estimate is an approximation or anticipated cost for specified a scope of work project or operation that is. A hedge can be constructed from many types of financial instruments including stocks exchange-traded funds insurance forward contracts swaps options gambles many types of over-the-counter and derivative products and futures contracts. Batch payments and payrolls.

Therefore to calculate the pip value for EURUSD when the pip size is 00001 the spot rate is 112034 and you are trading a position size of 100000 you would plug that information into the. Settle batches of invoices and make payrolls quickly and easily. Try our currency converter to get near real-time Interbank exchange rates for over 130 currencies whether you are looking to convert dollars to pounds or perform.

210 net 30 are payment terms where the payee will receive a 2 percent discount on the balance owed if payment is made within ten days. FX live rates and international payments service and transparent pricing structure. Now trading Trade a slice of Bitcoin futures with contracts 110 the size of one bitcoin offering an efficient way to fine-tune bitcoin exposure and enhance your trading strategies.

This is largely down to them being. Receive exclusive insights on key FX macro themes volatility trends and market events through our bi-weekly options report. A hedging transaction refers to a position that a market participant takes in order to limit risks related to another position or transaction that the market participant is.

For spot transactions the exposure is for only the two days between the trade date and the value date. An Outright Forward is a binding obligation for a physical exchange of funds at a future date at an agreed on rate. A popular approach to hedging the sale of an overseas property is to fix the value of the sale using an FX derivative such as a forward exchange contract.

In finance a derivative is a contract that derives its value from the performance of an underlying entity. Derivatives can be used for a number of purposes including insuring against price movements increasing exposure to price movements for speculation or getting access to. When you click that this window pops up and then you can search the NPV function in this box.

Estimate Estimation is the process of finding an estimate or approximation that is the numerical value of unknown population values from incomplete data such as a sample. Hedging results in margin requirements along with a change in the foreign exchange rates. Otherwise the full invoice balance is due in 30 days.

There is no payment upfront. A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. SWIFT SEPA and instant.

Now trading Trade a slice of Bitcoin futures with contracts 110 the size of one bitcoin offering an efficient way to fine-tune bitcoin exposure and enhance your trading strategies. We use multiple rails to deliver your payments in a timely manner including. For Forex XTB supports 48 currency pairs with low-cost spreads.

Rate and spread determination is a complex process and is often opaque. Non-Deliverable forwards NDF are similar but allow hedging of currencies where government regulations restrict foreign access. Customers of XTB can choose between trading on the xStation 5 or MT4 platforms.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. Hedging the risk involves an additional cost. For leverage accounts this brokerage offers.

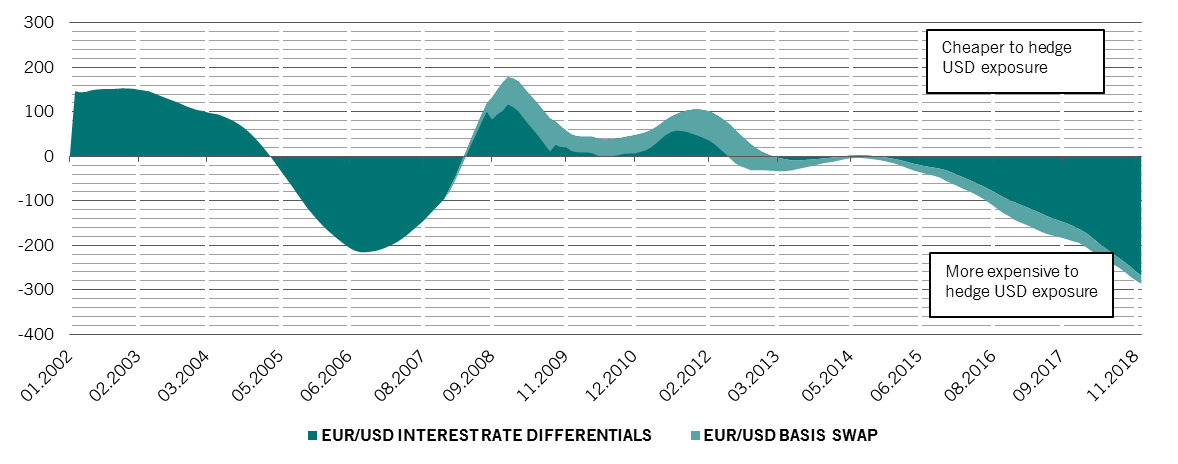

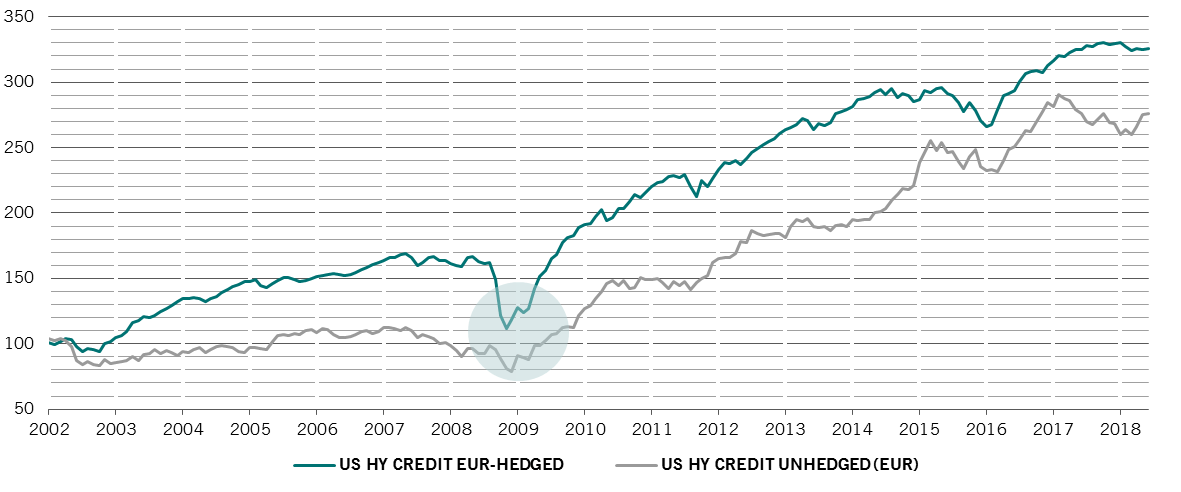

Receive exclusive insights on key FX macro themes volatility trends and market events through our bi-weekly options report. To calculate a brokers trust score we take into account a range of factors including their regulation history years in business liquidity provider etc. The cost or benefit of buying a forward is known at its purchase with the forward exchange rate calculated by discounting the spot rate using interest rate differentials.

The first method is clicking in this little Fx here. Limitations of Foreign Exchange Risks. Lock-in exchange rates up to 12 months in advance.

To the replacement cost of any deal in the event that the client cannot fulfill its obligations. There are two main ways of calling NPV function in Excel. OANDA fxTrade and OANDAs fx family of trademarks are owned by OANDA Corporation.

This underlying entity can be an asset index or interest rate and is often simply called the underlying. However for forward contracts the exposure is greater because the time between the trade date and the value date is. Forward exchange contracts are used by market participants to lock in an exchange rate on a specific date.

Get the latest rates with our FX Rate Calculator Get visibility into up-to-date exchange rates before sending a payment overseas in pounds euros yuan or any other listed currency. Interactive charting historical exchange rates and alerts.

Natural Hedging Benefits Disadvantages And More Financial Life Hacks Accounting And Finance Financial Management

Bill Spetrino In 2021 Fundamental Analysis Stock Screener Chart

Currency Hedging Western Union Business Solutions

Demystifying Currency Hedging Pictet Asset Management

Excel Optimal Hedging Strategy Template Optimization Excel Templates Risk Aversion

Always In Profit Forex Simple Hedging Forex Profit Simple

Portfolio Currency Hedging 101 Impacts And Costs What You Need To Understand Alfred Berg

Wmifor 3 5 For Mt5 With Dtw Engine Indicator For Metatrader 5 Engineering Candle Pattern Time Warp

Calc Partner Focuses On Providing Equipment For Corporations For Better Management Currency Risk By Itself Calc Marketing Data How To Plan Google Sheets

Ouro Hedge Scalping 3 0 Ea Cost 75 Download In 2021 Ea Words Risk Management Scalps

Fx Venom Pro Indicator Free Download Risk Management Price Chart Free Download

Portfolio Currency Hedging 101 Impacts And Costs What You Need To Understand Alfred Berg

Demystifying Currency Hedging Pictet Asset Management

How To Hedge Currency Risk Foreign Exchange Hedging Explained Ig En